Marketplace lending platforms are non-bank financial institutions that are suitable for lender lenders. They utilize technology to evaluate and process loan requests that allow simplified loan approval and origination. Traditional banks hold customer deposits to finance loans, and bank profits are a delta between the interest rates that banks pay back their deposit holders and their interest rates charge fees to borrowers. Marketplace lending has evolved from a peer-to-peer lending structure focused on retail initially dominated by institutional investors and technical hedge funds that buy loans directly from the platform. the level determination is done centrally based on the risk profile and the assessment methodology platform, not by the buyer of the loan itself. In the global MSME loan market - apart from the impressive mobile money ecosystem, cross-border payment business, and alternative loan businesses - affordable capital remains inaccessible to more than 200 million MSMEs. On a macro scale, the LIBOR (London Inter-bank Offers Rate) scandal shows how centralized exchange rate fixing can lead to manipulation and unfair practices in the global $ 300 trillion loan market.

Review Pngme and Pngcoin

Pngme is a global loan platform that gives institutional investors access to alternative classes of loan assets. Pngme is a new lending market built using blockchain technology, decentralized tariff setting algorithms, and digital credit valuation. The Pngme Market uses liquid digital assets (e.g. USD, Stable Coins, Bitcoin, Security Tokens, or USD-supported Property Tokens) and newly emerging non-equivalent digital asset classes that represent title ownership. Pngme has a mission to close the $ 5.2 trillion financial gap that affects 200 million MSMEs globally to reduce credit costs while increasing its accessibility, thereby encouraging sustainable economic growth from the base of the financial pyramid.

So in essence Pngme will create solutions and loan results with competitive markets that open access to digital asset-based capital with coverage of MFIs, Cellular Money Networks, and MSMEs. Loans contained in digital bonds can be guaranteed using traditional liquid digital assets, and / or cellphone locking technology, reducing the risk of the borrower as well as exposure to default borrowers. In addition Pngme will expand the credit rating model to business customers (MFIs) with service through mobile applications. This will produce a more accurate coupon rate and better results for the performance of digital bonds. its pricing model to impose a lower effective APR in order to stay competitive in the market and retain customers. Loan interest rates are set in a decentralized market using a reverse Dutch auction of lenders and market participants buy loans from borrowers at competitive prices based on transparent digital bond risk metadata. Our hybrid credit scores allow borrowers without formal credit scores to access effective credit costs through the MFI network and the Mobile Money Network that utilizes the mobile application. Investors will be able to determine their own risk exposure level and buy bonds including digital bonds that focus on the impact that yields the desired returns in an alternative asset class while producing alpha and yield.

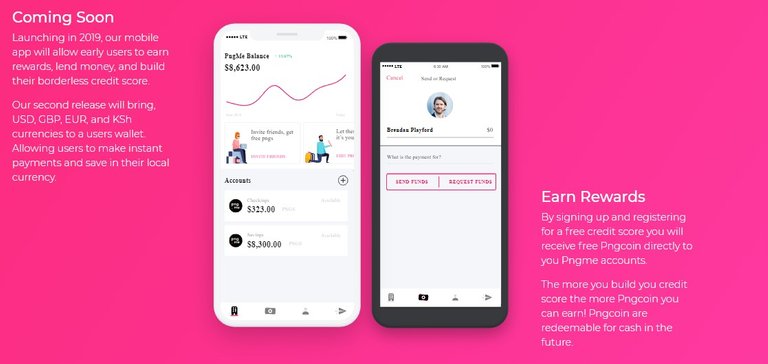

Because Pngme uses Blockchain-based technology, a token will be created which can later be used for transaction services on the platform. For the name of this token itself is Pngcoin (PNG). This token has been designed to seed Pngme with Pngcoin according to user adoption, thus defining liquidity tokens as a function of network growth - the faster the growth of users on the network, the faster the Pngcoin token economy expands using the dynamic model. Users can get tokens by registering to the Pngme mobile app, risking Pngcoin in their savings account, referring friends, or buying it through secondary markets. There will be no initial public sale of Pngcoin to investors or token buyers. However, Andromeda Technologies Ltd will be able to sell Pngcoin that is unlocked from its cash through token grants, personal sales or IEO, to finance the development, marketing and growth of the Pngme Network, Pngcoin, and Pngcoin betting services.

How Pngme can grow the MSME sector

Marketplace lending has seen rapid growth since the 2008 financial crisis after which lenders have sought greater returns on their assets than what can be obtained in depositing institutions or government bonds. In 2019, global market lending has experienced a 27% YoY growth from 2018, reaching $ 180 billion and is expected to reach $ 290 billion by 2023. With the introduction of a new digital credit assessment model, Pngme will be able to provide credit ratings to business owners that are equal or more accurately FICO to predict the risk of default. Using our technology stack, we will be able to unlock 6 funds of 200 million MSMEs globally that have underserved business credit demand in Indonesia exceeding $ 5.2 trillion per year.

By taking the first step by making a partnership as an initial stage with three corporate clients such as: US-based USD-C borrowers get loans of up to $ 50 million against 135%. The Cellular Money Network in Africa with 9,000 active agent businesses that want to finance the growth of their agent network to 100,000 using floating financing. The US-based sukuk issuer will be white labeled to serve Pngme's mobile app customers and take loans supported by tokenized property. This potential client has been sourced organically through our own internal network. We have further pipelines that we continue to build through the same channels at very low costs.

Pngme's direct competitors in the US that offer market loans are Lending Club, Lending Tree, and Upstart, serving most retail consumers and not serving the international market. They are a source of market liquidity from many lenders (offering 0% yield) and then transfer funds to their Field Partners - MFIs, non-profit organizations, and social impact foundations. These Field Partners then extend loans to their borrowers - MSMEs and individuals - charging interest rates high enough to cover their operating costs and often add limits. The Pngme platform increases debt capital to finance their loan books and then sets interest rates in the range of 50-250% APR (with an average default rate of 10%) using a mobile digital credit score and does not require collateral to secure loans.

Conclusion

Pngme is a global loan platform that gives institutional investors access to alternative classes of loan assets. So in essence Pngme will create solutions and loan results with competitive markets that open access to digital asset-based capital with coverage of MFIs, Cellular Money Networks, and MSMEs. PNG Token (PNG) has been designed to seed Pngme with Pngcoin according to user adoption, thus defining liquidity tokens as a function of network growth - the faster the growth of users on the network, the faster the Pngcoin token economy expands using the dynamic model.

Website : https://pngme.com/

Telegram Chat: https://t.me/pngmecommunity

Twitter: https://twitter.com/pngmemobile

Facebook: https://www.facebook.com/pngme/

Medium: https://medium.com/pngme

Instagram: https://www.instagram.com/

Reddit: https://www.reddit.com/r/pngme/

LinkedIn: https://www.linkedin.com/company/35697946

YouTube: https://www.youtube.com/channel/UCmUPIgu-xfdYijOS7eOwYyg

BitcoinTalk ANN: https://bitcointalk.org/index.php?topic=5140127

By

My Bitcointalk Link : https://bitcointalk.org/index.php?action=profile;u=1305012

My ETH Address : 0xCC028E8465c39c8B5D250431c82239dc7EE48a6d