The advanced arrangement of relations in the financial segment is intended to make a benefit, not to address client issues, and it fails to impress anyone. Banks regularly work just as aggregators of cash, while they can't generally give the populace a similar cash. A bank itself is over every one of the an organization of a budgetary sort that should work to support financial specialists, that is, pull in as huge level of the assets raised as could reasonably be expected. For this situation, individuals go to the bank for cash if fundamental and the bank issues on the supposition of its interests. There are additionally confinements on the quantity of banking items that are accessible to the person. A normal bank can have up to 20 unique items, many cards, yet they all work inside a similar framework, which is worked by the National Bank. Furthermore, the open door for the populace to acquire cash advantageously, proficiently, without hardly lifting a finger and straightforward rates just does not exist.

The advanced arrangement of relations in the financial segment is intended to make a benefit, not to address client issues, and it fails to impress anyone. Banks regularly work just as aggregators of cash, while they can't generally give the populace a similar cash. A bank itself is over every one of the an organization of a budgetary sort that should work to support financial specialists, that is, pull in as huge level of the assets raised as could reasonably be expected. For this situation, individuals go to the bank for cash if fundamental and the bank issues on the supposition of its interests. There are additionally confinements on the quantity of banking items that are accessible to the person. A normal bank can have up to 20 unique items, many cards, yet they all work inside a similar framework, which is worked by the National Bank. Furthermore, the open door for the populace to acquire cash advantageously, proficiently, without hardly lifting a finger and straightforward rates just does not exist.

Brief depiction of the venture

When all is said in done, the market for issuing such credits includes a high turnover of assets and an amazingly enormous rate of non-installment with a huge deferral in installments. This prompts the way that it is conceivable to issue an advance to a customer just at a financing cost of over 100% per annum. This, thusly, cuts off conventional banks from the likelihood of infusing assets into MFIs to decrease the financing cost. Since the scoring framework can't work so rapidly and settle on choices for every customer, there is a requirement for countless enlisted faculty, the presentation of an improved scoring method just as an expansion in financing costs so as to pull in potential ventures. Surely, such organizations have totally dark work plans.

Market investigation

Around 200 million individuals worldwide are at present customers of microfinance associations, and as indicated by different appraisals, the market size is from USD 60 to 100 billion. In 2018, examiners from responsAbility expect an expansion in the global market of MFIs by 15–20%, with Asian nations giving the key portion of development. As indicated by the examination MICROFINANCE Gauge 2018, in 2015, non-bank money related establishments worked with 43% of borrowers around the world, while among banks this figure was 26%, and among non-benefit associations – 27%. In the meantime, the normal size of a bank credit was USD 1,576, an advance from non-banking monetary establishments – USD 766, an advance from non-benefit associations – USD 334. It is likewise significant that the 100 biggest microfinance associations worked with 78% of the absolute number of borrowers.

Mission of item

Self-governance. It doesn't make a difference wherein ward the customer is found. All procedures are completely mechanized. A bank can acknowledge and issue cash in any money of the world and principle cryptographic forms of money. The limitation on the bank rate or the financial approach of provincial banks totally vanishes. There are no limitations on how regularly a bank can send cash to another country or depend intensely on the likelihood of arrangement of money obstruction. Approvals, political choices – this progresses toward becoming secondary.Bank rate. All banks rates are steady. From one viewpoint, it is advantageous in light of the fact that it enables you to keep benefit at a similar level. Nonetheless, considering the rates and guideline of cash course by national banks, there is no conviction that the rate won't be forcefully raised. This legitimately influences the size of business and community to both credit and store assets. In the proposed undertaking, the loaning rate and productivity depend fundamentally on the item biological system. The rate will be equivalent to such a worth, which from one perspective will permit expanding the budgetary resources of the bank (expanding the quantity of advances) and then again – guaranteeing a base enthusiasm on acquired assets. Furthermore, given that the enthusiasm for the task will be gigantic and the rate will be negligible – this will quicken the development of the turnover of assets and subsequently, increment the yield.

Worldwide issues and our answer

Restricted gathering pledges. All MFIs experience the ill effects of the way that they can't collect a great deal of cash. In the meantime, organization and transient credits are not fascinating for banks, since microfinancing in the conventional mode requires numerous workplaces and an ideal scoring framework. As needs be, the development of the customer base is constrained. The proposed venture takes care of this issue by bringing simulated intelligence Bank to the microfinance showcase, which does not require costly workplaces, various staff, the expenses of the legitimization of money related exercises in a specific nation and gives a scoring framework dependent on AIB Scoring framework. So as to assess customers, it is important to download every one of the information on them into the framework. This, thusly, limits the precision, speed, and versatility of doling out a FICO assessment. In the proposed task, the scoring framework depends on programmed forms and right away performsall the vital methodology with high accuracy.Competitiveness. In the market of created nations, it is negligible. In creating nations and economies on the move, it is high. To pull in acquired assets in MFIs for turnover, the loan cost for financial specialists ought to be higher than in bank stores. As needs be, the issuance of credits to MFIs is just conceivable at an extremely high financing cost. The loan cost in the proposed undertaking is set consequently and along these lines the issue of the impact of national banks is totally gone. The proposed undertaking is completely aggressive and has no contenders.

Token

AIB Utility Token

USD 0.05 the cost of one AIB token

Discharge: 856,750,000 tokens

USD 250,000 private pre-closeout of tokens, 5,000,000 tokens

Reward with a private pre-closeout of 35%.

USD 2,000,000 Delicate Top

USD 30,000,000 Hard CapToken

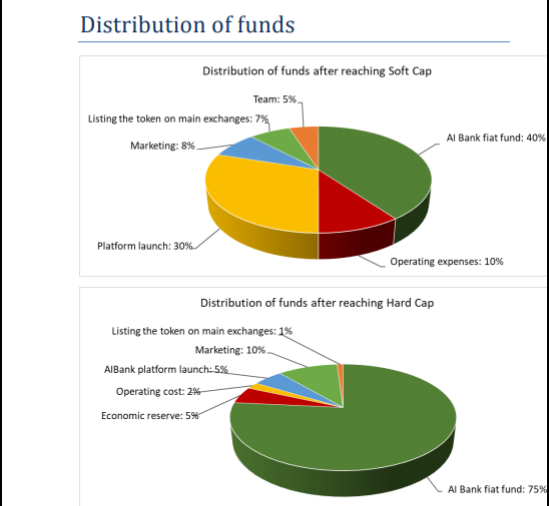

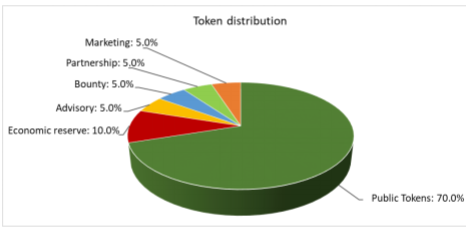

Token circulation:

Open tokens (private deal, ICO) – 70% – 600,000,000 tokens

Financial save – 10% – 85,000,000 tokens

Warning – 5% – 42,500,000 tokens

Abundance – 5% – 42,500,000 tokens

Organization – 5% – 42,500,000 tokens

Showcasing – 5% – 42,500,000 tokens

The crowdsale of the AIB token will be directed in two phases: Private Deal and ICO. Everybody is permitted to partake in the two phases with no confinement, however there are noteworthy contrasts in the subtleties. "Delicate Top" signifies the base sum required for the usage of the artificial intelligence Bank venture. "Hard Top" is the most extreme measure of an AIB token that can be sold. The outflow of the AIB token suggests that members who wish to help the improvement of man-made intelligence Bank can do this by sending monetary assets or cryptographic money to the assigned imperatives. Thusly, they purchase AIB tokens at a cost of USD 0.05 for one AIB token, which are quickly sent under a brilliant contract to their ERC-20 tote.

For more data

Site: https://aibank.global

White paper: https://aibank.global/whitepaper.pdf

Twitter : https://twitter.com/AIBank4

Facebook : https://www.facebook.com/man-made intelligence Bank-Worldwide 2334412266838969/

Linkedin : https://www.linkedin.com/in/aibank/

Wire : https://t.me/aibankofficial

Instagram : https://www.instagram.com/aibankglobal/

Bitcointalk: https://bitcointalk.org/index.php?topic=5118626

Bountyox username : olatunjipaul

Super Listing

Congratulations @omogold! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!