It is well known fact that money supply does inflate prices of assets.

We also know the issues associated with tether supply i.e. whether all the supply is backed by real dollars in banks or not. It is claimed that tether is using fractional reserve based policy to increase supply of tether similar to that of all the central banks around the world.

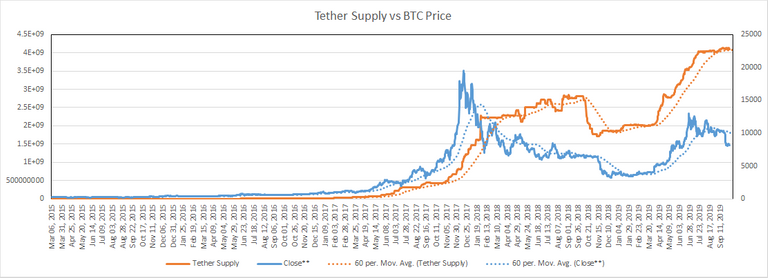

Therefore, I computed tether supply and plotted that with BTC price and same is displayed in above graph. There is remarkable similarity between the two. In fact tether supply increase inevitably leads to increase in BTC prices and similarly decrease in tether supply also leads to decrease in BTC prices but at times does not correlate that well. There seems to be some time lags i.e. first tether supply reacts and then BTC prices.

Now we have large number of stable coins. However, the tether still makes up nearly 85-90% of total market cap of stable coins. One can check the details at StableCoins Details at Santiment.

It is expected that supply of stable coins will keep increasing going forward. Therefore, it is important that market participants keep a close watch on this development.

I wonder how much correlation there would be if you tracked the supply of ALL stablecoins on this chart.

Posted using Partiko iOS

Will work on that and make a post soon