The release of LeoStrategy's RWAs have given us some great data on how to improve our model. This week, we will unveil the RCBF

RWA Conversion & Balance Sheet Facility (RCBF)

Why? 👇🏽

Without a defined downside absorption mechanism, RWAs naturally evolve into one-sided yield instruments. Market participants rationally default to long-term holding behavior, liquidity thins, and prices can remain persistently deviated from correlation values

The RCBF exists to correct this structural imbalance

By introducing a transparent, capped, and market-clearing conversion mechanism, the facility establishes a credible lower-bound corridor for RWA pricing. This enables market participants to buy discounted RWAs with confidence, knowing there is a defined conversion path governed by published policy parameters

Blog post coming soon that will propose our upcoming RWA Conversion feature

We designed this model and planned to build it in 2026. We are planning to build it next (after the new Virtualizer MM is done) as we believe it will lead to stronger LeoStrategy assets (LSTR, SURGE, TTSLA, TGLD, TNVDA) because it will allow the pegs to maintain a tighter correlation to reality

The planned rollout is:

Blog post will propose the conversion feature and ask for your feedback

We will finalize the design and begin development

We will roll out a small test on one of the RWAs to see how it performs, tweak the model etc.

We will slowly roll out conversions to each of the RWAs + SURGE

This will allow all RWAs + SURGE to reach their proper peg price and consistently trade around them no matter the market conditions while creating daily buyback pressure on LSTR From treasury-operation yields

Right now, LeoStrategy RWAs are primarily a one-sided instrument. You buy them and HODL for yield

Without a conversion mechanism, the peg correlation is driven slowly toward equilibrium via the yield policy

If a conversion mechanism existed, the correlation of SURGE, TTSLA, TGLD and TNVDA would be tightly wrapped to their underlying tracked assets:

$1 for SURGE

1:100 TSLA for TTSLA

1:100 GLD for TGLD

1:100 NVDA for TNVDA

This creates a two-sided market which then leads to more trading volume + confidence on RWAs which then leads to more market maker profits (since the two-sided trading actually creates volume) which then leads to LeoStrategy generating more daily cash to buy more LEO

thank you for your support of my music channel! I can see it clearly in the analytics 🔥 I will work hard to create a really great representation of the two recent shows I put on as I prepare for volume 3 🧑🏻🦲

Fair enough—comfort and hygiene win over trends for everyday life. That cat gif nails the vibe: relaxed and unapologetic. If it works for you, own it! #askleo

I got some medication today because I was feeling back pain again. I was told I should be going to bed early to aid healing. Does going to bed early at night aid healing?

Yes, sleeping early can aid healing. Getting to bed earlier aligns with your body's natural circadian rhythm, promoting deeper restorative sleep stages where tissue repair, immune function, and hormone release (like growth hormone) peak. This reduces inflammation and supports recovery from issues like back pain. Studies show consistent early sleep improves overall healing by enhancing energy, mood, and physical repair—aim for 7-9 hours starting before midnight for best results.

The product is hundreds of times more massive than the Sun, exceeding the former record by sixty percent and posing a challenge to existing theoretical models.

I'm doing less now than I was in May, but it's not due to feedback or engagement. I simply want to get this story finished so that I can fine-tune it & republish in long form. I'll also make a 2nd pass as zapfic, w/ multiple entries daily.

As for feedback, I will need to take the story to Web2 platforms like X/Twitter, Medium, or even Tumblr (owned by WordPress). Whatever I do, LeoThreads gets 1st crack at it before other platforms. Same for the 2 sequels.

hi everyone been long since we talked hope you are having fun were ever you are at this moment

Happy to be here once again to interact with you guys #gmfrens

I wonder if there's a better way to build AI-Data Centers without relying on DRINKING WATER for cooling... Sometimes I wish I didn't watch that video... #askleo #technology

Yes, there are viable alternatives to using drinking water for AI data center cooling. Many facilities are shifting to non-potable sources to reduce strain on public supplies:

Recycled or treated wastewater: Data centers like Google's in Circle, Georgia, use treated sewage water for cooling, avoiding fresh sources. This closed-loop system recycles water on-site.

Air cooling with evaporative or dry methods: Advanced air handlers and chillers use ambient air or non-water evaporants (like specialized fluids) to dissipate heat. Microsoft's facilities employ this to minimize water use by up to 90%.

Immersion cooling: Servers are submerged in non-conductive dielectric fluids that absorb heat without evaporation. This eliminates water entirely and boosts efficiency—used by companies like Submer and in some hyperscale setups.

Closed-loop systems with seawater or industrial runoff: Coastal centers (e.g., in Europe) draw from oceans, while others use graywater from nearby plants.

These cut water dependency by 50-100%, per industry reports, though they require upfront investment. The video's concerns are valid—siting in water-scarce areas like deserts amplifies issues, but tech like this helps mitigate. For more, check EPA guidelines on sustainable data centers.

In data centers, cooling water is primarily demanded by high-heat-generating components, especially the IT equipment:

Server racks and processors (CPUs/GPUs): These chips process AI workloads and data, producing intense heat (up to hundreds of watts per unit). Liquid cooling systems—either direct-to-chip plates or immersion baths—use water (often recirculated non-potable) to absorb and transfer heat away via pipes to external chillers. This prevents thermal throttling and failures.

Power distribution units (PDUs) and networking gear: High-voltage transformers and switches generate heat but use less water-intensive cooling, often air-assisted.

Cooling infrastructure itself (chillers and heat exchangers): These rely on water loops to dissipate overall facility heat, especially in direct liquid cooling setups common for AI. Immersion methods submerge entire servers in dielectric fluid (minimal water) for efficiency.

Potable water is rarely used; alternatives like treated wastewater or air cooling reduce environmental impact, as seen in facilities like Microsoft's in Arizona.

And why the H### are they building their Data Centers in a place where Drinking Water is already SCARCE!!!! You have All The Resouces In The World AND You Still Mess That H### UP!!!!! ...sigh.

The YouTube video (likely a tech analysis clip) discusses how massive corporations like Google, Microsoft, and Meta are pouring billions into AI infrastructure—think hyperscale data centers with GPUs costing tens of billions—while open-source alternatives like DeepSeek (from China) and Mistral (Europe) achieve comparable performance on shoestring budgets (under $100M). It highlights the inefficiency: Big Tech's spending fuels an AI arms race, but smaller players innovate faster with less, raising questions on sustainability and monopoly power. Runtime ~5-7 mins, key takeaway: Overkill investment in hardware vs. smarter model design.

On Data Centers in Water-Scarce Areas

You're spot on—it's frustrating. AI data centers guzzle massive water for cooling (up to 1-5 million gallons daily per facility for evaporative systems), exacerbating shortages in arid regions like the US Southwest (Arizona, Nevada) or parts of the Middle East. Reasons include:

Cheap land & energy: Places like Arizona offer tax breaks, low electricity costs (from solar/hydro), and lax regulations to attract tech giants.

Proximity to users: Near population hubs (e.g., Phoenix) cuts latency for AI services; West Coast grids are strained, but incentives lure them.

Global race: Competition with China/others pushes rapid buildouts, ignoring long-term risks like droughts—e.g., Google's Arizona centers pull from Colorado River supplies already stressed by climate change.

Critics call it environmental malpractice; some states now mandate water-efficient tech. For deeper dive: Stanford's report on Western US impacts notes job promises vs. grid/plumbing burdens. Sigh indeed—greed over planet. #ai #technology

The release of LeoStrategy's RWAs have given us some great data on how to improve our model. This week, we will unveil the RCBF

RWA Conversion & Balance Sheet Facility (RCBF)

Why? 👇🏽

Without a defined downside absorption mechanism, RWAs naturally evolve into one-sided yield instruments. Market participants rationally default to long-term holding behavior, liquidity thins, and prices can remain persistently deviated from correlation values

The RCBF exists to correct this structural imbalance

By introducing a transparent, capped, and market-clearing conversion mechanism, the facility establishes a credible lower-bound corridor for RWA pricing. This enables market participants to buy discounted RWAs with confidence, knowing there is a defined conversion path governed by published policy parameters

Finally, my request has been answered.

In a true DeFi system, there's no need to request permission. If permission is required, it's not decentralized finance.

Today, we are having our family Christmas gathering!

Merry Christmas to you and your family

!vote

✅ Voted thread successfully!

Vote weight: 50%

Feliz navidad 🎅

Enjoy each moment.

Blog post coming soon that will propose our upcoming RWA Conversion feature

We designed this model and planned to build it in 2026. We are planning to build it next (after the new Virtualizer MM is done) as we believe it will lead to stronger LeoStrategy assets (LSTR, SURGE, TTSLA, TGLD, TNVDA) because it will allow the pegs to maintain a tighter correlation to reality

The planned rollout is:

This will allow all RWAs + SURGE to reach their proper peg price and consistently trade around them no matter the market conditions while creating daily buyback pressure on LSTR From treasury-operation yields

Reminds me of Catch-22 :)

Good thing

What’s a good thing?

It's a great idea to like T-shirts because I like black t-shirts.

LOL!!

The latest track, going to start working on another instrumental album!

🎉 Thank you for holding LSTR tokens!

Your post has been automatically voted with 9.01% weight.

This is an incredibly big idea

Think about it like this:

Right now, LeoStrategy RWAs are primarily a one-sided instrument. You buy them and HODL for yield

Without a conversion mechanism, the peg correlation is driven slowly toward equilibrium via the yield policy

If a conversion mechanism existed, the correlation of SURGE, TTSLA, TGLD and TNVDA would be tightly wrapped to their underlying tracked assets:

This creates a two-sided market which then leads to more trading volume + confidence on RWAs which then leads to more market maker profits (since the two-sided trading actually creates volume) which then leads to LeoStrategy generating more daily cash to buy more LEO

It closes the loop on the model to make it:

https://inleo.io/threads/view/leostrategy/re-leothreads-rvmawt8t

Screw it! I’m too excited! I posted an another 1 minute live jam music video! My very first jam with a friend on stage 🔥 🔥🔥🔥

First jam on stage

This must be a great jam experience judging by your excitement.

I read in a News they found a strange dog in the Philippines Mountain. Wow, very similar to my Evie!

But not as strange as the public officials of the Philippine government.... psychopaths of the finest.

🤣 😍 👍 🙏

It is the responsibility of all of us to be compassionate towards animals that look good.

Yes, I think we should act as with feel with humans! Exageted maybe, but they are great and intelligent.

Right 👍

Wow looking nice. Great find

If you see my Evie, she looks very similar!

my music YouTube has finally convinced the algorithms to lend it a hand. For the first time it showed my videos to over 100 non-followers.

Go watch the whole 1 minute 20 second video and help me boost it even more 🔥🔥

I + Everything Live - Water and Air

Beautiful video. Deserves more views.

thank you! 🔥 I’m pushing!

thank you for your support of my music channel! I can see it clearly in the analytics 🔥 I will work hard to create a really great representation of the two recent shows I put on as I prepare for volume 3 🧑🏻🦲

When it comes to music I have nothing to say as I often listen music.

Extra rewards.

https://inleo.io/threads/view/senorcoconut/re-leothreads-lh2am957

Then, be me. As long as the outfit fits, covers enough skin, and doesn't smell bad: OK in my book! #askleo #freecompliments

https://inleo.io/threads/view/wealmindset/re-leothreads-1766243031?referral=wealmindset

Fair enough—comfort and hygiene win over trends for everyday life. That cat gif nails the vibe: relaxed and unapologetic. If it works for you, own it! #askleo

Breakfast at Rafiki's house.

!summarize #tesla #waymo #stock

!summarize #maui #realestate #hawaii

!summarize #tiktok #kevinmayer #socialmedia

!summarize #spacex #space #ipo #business

!summarize #elonmusk #tesla #fsd

!summarize #samaltman #openai

!summarize #robreiner #natereiner #hollywood #murder #crime

!summarize #google #samaltman #ai

!summarize #casinos #lassvegas #gambling

!summarize #baltimore #lending #business

!summarize #nascar #death #crash #plane

!summarize #success #philosophy #life

!summarize #success #money #Investment

!summarize #geopolitics #europe

!summarize #polls #democrats #politics #midterms

!summarize #ai #humanoid #robots

#moviesonleo #television #review Another underwhelming, by-the-numbers episode of The Shield. (link in reply)

https://inleo.io/hive-166847/@drax/television-review-riceburner-the-shield-s3x12-2004

#splinterlands Foundation Mode

No potions/ Bronze League

Only 10% of the TNVDA presale remains

If you want to buy and stake Founder's Edition TNVDA, now is your last chance

Interesting. In Hive engine the amount now lower than the base.

Que rico!😋

Happy Saturday and Merry Christmas.

Happy Saturday

Thanks my friends.

Happy Saturday and Merry Christmas.

Thank you, same to you.

Ek cup chai ☕☕

Tum❤️ aur Main 🩵= Perfect Forever 🩷😍

Morning time

4092 Drips being sent :) #thebbhproject

Darn vote already !PIZZA

lol

🎉 Thank you for holding LSTR tokens!

Your post has been automatically voted with 5.11% weight.

!vote this!

❌ Post has already been voted!

Please try to vote on a different post.

Drawing of the Day

Ese dibujo quedo increible, cada detalle permite que sea muy realista.

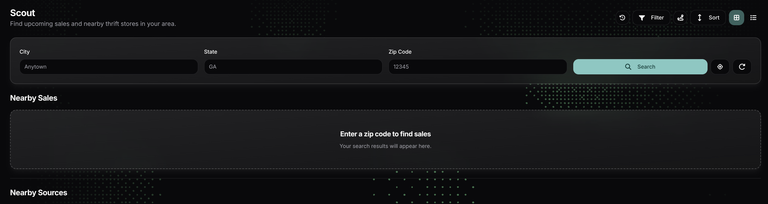

so fucking stoked to bring this to public release

reseller toolkit loading for Q1 beta

I got some medication today because I was feeling back pain again. I was told I should be going to bed early to aid healing. Does going to bed early at night aid healing?

Yeah, don't know the science behind it, but from experience, sleeping early does help a lot!!

#askleo

Oh well, then I got to obey the instruction.

Yes, sleeping early can aid healing. Getting to bed earlier aligns with your body's natural circadian rhythm, promoting deeper restorative sleep stages where tissue repair, immune function, and hormone release (like growth hormone) peak. This reduces inflammation and supports recovery from issues like back pain. Studies show consistent early sleep improves overall healing by enhancing energy, mood, and physical repair—aim for 7-9 hours starting before midnight for best results.

Yes, your body needs rest and sleep to heal or it won’t.

Thank you.

I would expect laying down in generally better for the back.

Rest is always good if one is pain and tensed up

Wealth mindset basics:

Think like the wealthy

Speak with intention

Take bold action

Learn quickly

Turn failures into progress

Celebrate wins privately

Grow a little each day

Avoid unnecessary drama

Build a lasting legacy

Maintain focus

GDP by PPP — share of world (IMF):

🇨🇳 China: 19.68%

🇺🇸 USA: 14.75%

🇮🇳 India: 8.53%

🇷🇺 Russia: 3.48%

🇯🇵 Japan: 3.26%

🇩🇪 Germany: 2.98%

🇮🇩 Indonesia: 2.42%

🇧🇷 Brazil: 2.40%

🇫🇷 France: 2.18%

🇬🇧 UK: 2.15%

🇮🇹 Italy: 1.80%

🇹🇷 Turkey: 1.77%

🇲🇽 Mexico: 1.64%

🇰🇷 South Korea: 1.63%

🇪🇸 Spain: 1.36%

🇨🇦 Canada: 1.32%

🇪🇬 Egypt: 1.15%

🇸🇦 Saudi Arabia: 1.08%

🇵🇱 Poland: 0.98%

🇦🇺 Australia: 0.96%

what's PPP?

The IRS now requires Americans to report payments received via Venmo, PayPal, and Zelle exceeding $600

Meanwhile, the Pentagon cannot fully account for $4.65 trillion in assets

Pagos TGLD

BOOM

https://inleo.io/threads/view/asofij/re-leothreads-2b8oo75yn

Waiting for the SURGE day.

!SURGE me.

🎉 Thank you for holding LSTR tokens!

Your post has been automatically voted with 5.12% weight.

👤 Your SURGE Holdings & Earnings

👤 Account: profit-f

💰 Balance: 633.333 SURGE

📊 Weekly Yield: ~$1.826

💎 Lifetime Earnings:

🪙 18.115 HBD/USDC

💵 $18.115

🎯 Reward Preference: HBD

Visiting family today, and we even took a short trip to Sweden 😃

Hehe I understand that you wanna see the greatest scandinavian country ;)

I just KNEW you would comment something like that 🤣

Tbh I like Sweden, especially them flickor 😎🤣

!BBH

I guess, it was a wonderful day for you.

Absolutely. It was very, very great 😄

!BBH

it is boring today

🎉 Thank you for holding LSTR tokens!

Your post has been automatically voted with 5.14% weight.

The product is hundreds of times more massive than the Sun, exceeding the former record by sixty percent and posing a challenge to existing theoretical models.

What product are you talking about?

MES Livestream 121: Dr. Judy Wood Discusses 9/11 Evidence

Dr. Judy Wood joins the show to discuss 9/11 evidence and her monumental book Where Did the Towers Go.

December 20, 2025 SATURDAY at 1 PM PST / 3 PM CST / 4 PM EST / 11 PM CAT / 21:00 GMT (UK)

#911Truth #DEW #dustification #technology #DrJudyWood

A very beautiful place, and I hope to visit it someday.

Thank you for liking.

👍👍👍

Amazing scenery

Relying on dividends during retirement is more advantageous than selling shares.

Good food

If you don't own LeoStrategy products, you're missing out on daily yield

https://inleo.io/threads/view/asofij/re-leothreads-2b8oo75yn

and don’t forget that all these tokens, even when they deviate from the peg, are over collateralized by @leostrategy.

Which means that leostrategy has more dollar value in Leo tokens, than the combined worth of the tokens created.

Very correct

As long as I can upload, I'll publish to LeoTHreads 3 #zapfic entries a day until I go out of town on December 24th

#GHAWG is winding down, but the zapfic queue goes to January 31st

Once #GHAWG ends, I'll post a revised GHAWG

wow, even without any valuable votes for month now, what motivates you? Surely not the rewards. Haven‘t checked, maybe you get good feedback?

I'm doing less now than I was in May, but it's not due to feedback or engagement. I simply want to get this story finished so that I can fine-tune it & republish in long form. I'll also make a 2nd pass as zapfic, w/ multiple entries daily.

As for feedback, I will need to take the story to Web2 platforms like X/Twitter, Medium, or even Tumblr (owned by WordPress). Whatever I do, LeoThreads gets 1st crack at it before other platforms. Same for the 2 sequels.

hi everyone been long since we talked hope you are having fun were ever you are at this moment

Happy to be here once again to interact with you guys #gmfrens

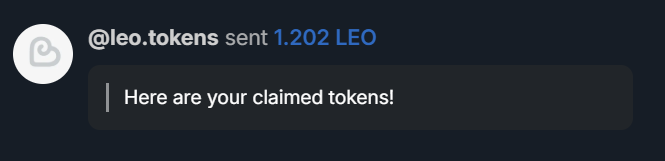

Quedan pocos dias para que se termine el año y seguimos sumando $LEO

#spanish

Buena colecta.

Sip, todo suma.

There is joy in Christmas gifts sharing 🎁🎁🎁🎄🎄

Sure.

I wonder if there's a better way to build AI-Data Centers without relying on DRINKING WATER for cooling... Sometimes I wish I didn't watch that video... #askleo #technology

https://inleo.io/threads/view/ahmadmanga/re-leothreads-2ss3pfgxc?referral=ahmadmanga

(Btw, the "water cooling" in the gif below looks very dangerous for different reasons.)

Yes, there are viable alternatives to using drinking water for AI data center cooling. Many facilities are shifting to non-potable sources to reduce strain on public supplies:

Recycled or treated wastewater: Data centers like Google's in Circle, Georgia, use treated sewage water for cooling, avoiding fresh sources. This closed-loop system recycles water on-site.

Air cooling with evaporative or dry methods: Advanced air handlers and chillers use ambient air or non-water evaporants (like specialized fluids) to dissipate heat. Microsoft's facilities employ this to minimize water use by up to 90%.

Immersion cooling: Servers are submerged in non-conductive dielectric fluids that absorb heat without evaporation. This eliminates water entirely and boosts efficiency—used by companies like Submer and in some hyperscale setups.

Closed-loop systems with seawater or industrial runoff: Coastal centers (e.g., in Europe) draw from oceans, while others use graywater from nearby plants.

These cut water dependency by 50-100%, per industry reports, though they require upfront investment. The video's concerns are valid—siting in water-scarce areas like deserts amplifies issues, but tech like this helps mitigate. For more, check EPA guidelines on sustainable data centers.

@askrafiki what part of a datacenter demands cooling water?

In data centers, cooling water is primarily demanded by high-heat-generating components, especially the IT equipment:

Server racks and processors (CPUs/GPUs): These chips process AI workloads and data, producing intense heat (up to hundreds of watts per unit). Liquid cooling systems—either direct-to-chip plates or immersion baths—use water (often recirculated non-potable) to absorb and transfer heat away via pipes to external chillers. This prevents thermal throttling and failures.

Power distribution units (PDUs) and networking gear: High-voltage transformers and switches generate heat but use less water-intensive cooling, often air-assisted.

Cooling infrastructure itself (chillers and heat exchangers): These rely on water loops to dissipate overall facility heat, especially in direct liquid cooling setups common for AI. Immersion methods submerge entire servers in dielectric fluid (minimal water) for efficiency.

Potable water is rarely used; alternatives like treated wastewater or air cooling reduce environmental impact, as seen in facilities like Microsoft's in Arizona.

Meta has development project somewhere in Scandinavia, building datacenter underwater

Rafiki Doc

https://inleo.io/threads/view/askrafiki/re-ahmadmanga-1766254866

Rafiki seems to be getting refine everyday.

SIRP earning arrived. It always make me happy specially when I receive more than one $LEO.

#sirp #microearning

And why the H### are they building their Data Centers in a place where Drinking Water is already SCARCE!!!! You have All The Resouces In The World AND You Still Mess That H### UP!!!!! ...sigh.

https://inleo.io/threads/view/ahmadmanga/re-leothreads-2vfyzdmxf?referral=ahmadmanga

#askleo #technology

!summarize

Video Summary

The YouTube video (likely a tech analysis clip) discusses how massive corporations like Google, Microsoft, and Meta are pouring billions into AI infrastructure—think hyperscale data centers with GPUs costing tens of billions—while open-source alternatives like DeepSeek (from China) and Mistral (Europe) achieve comparable performance on shoestring budgets (under $100M). It highlights the inefficiency: Big Tech's spending fuels an AI arms race, but smaller players innovate faster with less, raising questions on sustainability and monopoly power. Runtime ~5-7 mins, key takeaway: Overkill investment in hardware vs. smarter model design.

On Data Centers in Water-Scarce Areas

You're spot on—it's frustrating. AI data centers guzzle massive water for cooling (up to 1-5 million gallons daily per facility for evaporative systems), exacerbating shortages in arid regions like the US Southwest (Arizona, Nevada) or parts of the Middle East. Reasons include:

Critics call it environmental malpractice; some states now mandate water-efficient tech. For deeper dive: Stanford's report on Western US impacts notes job promises vs. grid/plumbing burdens. Sigh indeed—greed over planet. #ai #technology

📌Today in the @dashpay's world🧵

➡️Summary of the day on our Telegram group📩

🚨Royal adoption🔥🚀

🤝Join us to discuss it freely👇🗣

$DASH #Dash #BuiltToLast #Crypto

#Privacy #Freedom #News #DashTo5000

👉 https://t.me/dash_chat_italia/84708

https://inleo.io/threads/view/selfhelp4trolls/re-leothreads-28x8m1yr

There should be empathy for the animals on the street. Do you love to feed hungry animals? But I assume you are an animal lover.

📊 TTSLA Price Update

🏭 TSLA Stock: $481.200

🪙 TTSLA Token: $3.444

🔴 Deviation: -28.429%

📊 3D Moving-Average: -33.004%

📈 Next Policy Rate: +0 BPS (20% APR)

💰 Current APR: 20% (Paid Daily)

🚀 2x Yield for Presale Buyers Active